The unfunded promises of public sector pensions are in the news, with the Detroit bankruptcy. Josh Rauh at Stanford and Hoover has a nice blog post on the subject titled "

Public Sector Pensions are a National Issue''. (Josh and Robert Novy-Marx wrote a very influential

paper (

ssrn manuscript) alerting us to the size of the state and local pension bomb.)

Josh's baseline number for the value of underfunded pensions: $4 trillion. Why so big, and why is this a surprise? Because many governments calculate their funding by assuming they will earn 8% per year. Discounting a riskless liability (pensions) at a risky rate is a basic error in finance. It's made all the time. University presidents are notorious for demanding their endowments "reach for yield" in order to "make our rate of return targets."

Reading this piece sparks a few thoughts about the risks posed by pensions and other unfunded liabilities.

Let's report risksHow to make the error clearer? Perhaps focusing on present values and arguing about discount rates obfuscates the issue. Let's talk about risk. Maybe it would clear things up if pensions had to report a "shortfall probability" or "value at risk" calculation like banks do. OK, you are assuming an 8% discount rate because you're investing in stocks. What's the chance that your investments will not be enough? Coincidentally, when I saw Josh's piece I was putting together a problem set for my fall class that illustrates the issue well.

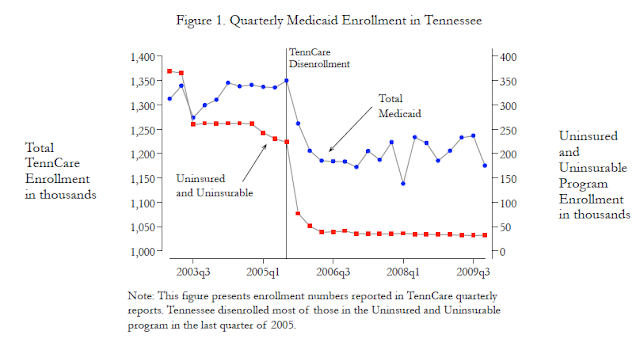

Here is the distribution of how much money you will have in 1, 5, 10, and 50 years if you invest in stocks at 6% mean return, 20% standard deviation of return. I added the mean in black, the median (50% of the time you earn more, 50% less) and the results of a 2% risk free investment in green. (The geometric mean return is 4% in this example.)

(Note: there is a picture here. I've noticed this blog is getting reposted here and there in text-only form. Go to the original if you want the pictures)

The mean return looks pretty good. After 50 years, you get $20 for every dollar invested, or contrariwise an accountant discounting a promise to pay $20 of pensions in 50 years reports that the present value of the debt is only $1. But you can see that stock returns (these are just plots of lognormal distributions) are very skewed. The mean return reflects a small chance of a very large payoff.

In these graphs the chance of a shortfall is 54, 59, 62, and 76% respectively. As horizon increases, you are almost guaranteed not to make the projected (mean) return! The median returns -- with 50% probability of shortfall, in red -- are a good deal lower. And the modal "most likely" return is below the riskfree rate in each case.

How is it that people get this so wrong? Let's look at the distribution of annualized returns in each case. Remember, these are exactly the same situations, we're just reporting a different number.

In these pictures, the distribution of annualized returns is symmetric, the mean and median are the same, and the distributions get narrower and narrower for longer horizons.

Comparing the two graphs, you see that annualized returns are profoundly misleading about the risks you're taking. Annualized returns have a standard deviation that goes down at the square root of horizon. But the actual return has a standard deviation that goes up at the square root of horizon, and exponentiating makes it skewed with the larger and larger chance of underperformance. Money matters, not annualized returns.

So as usual, when arguments are getting nowhwere, perhaps we need to shift the question: please report your shortfall probabilities. And your plans for what you do with shortfalls.

In many of those cases, the plan for shortfall comes down to "the Federal Government bails us out" (or ERISA bails out private plans.) Well, if that's true, then we have a different and interesting discounting question. Maybe 8% is the right number if someone else pays the losses!

Finance also teaches us to think about "state contingent payoffs." What does the whole world look like in the bad events? If cities and states can't pay their pensions, this very likely because stocks have performed badly, and because we've had 20 years of sclerotic growth, no growth in tax revenues, to fund the pensions. Stock returns are not uncorrelated with other aspects of state, municipal, and corporate finance. Investing in stocks to fund pensions is like selling fire insurance on your house, rather than buying it. If the house burns down, then you pay the insurance company.

What debt really matters?Even $4 trillion is not all that huge in the grander scheme of things. The official Federal debt is $18 trillion. But if you add the present value of unfunded pensions, social security, medicare, Obamacare, and so on you can get numbers like $50 trillion or more. Which, it should be perfectly obvious, are not going to get paid, especially if we stay on the current slow growth trajectory. But how important is this present-value observation? Should we routinely add up all the unfunded promises, discount them properly using the Treasury yield curve, and report the grand total?

I worry most about runnable debt. Promises to pay people trillions in the far off future are a different thing than rolling over marketable debt every year. If it looks likely we won't be able to pay pensions in 20 years, there's not all that much pensioners can do about it. If it looks like we won't pay off formal short-term debt, markets can fail to roll over, leading to an immediate financial crisis.

So, much as I value Josh's calculation, and zinging those who want to minimize the necessity of ever paying off debt, it does seem there is a difference between marketable debt that needs to be rolled over every year and promises to pensioners and social security that may eventually be defaulted on, but can't cause an immediate crisis.

The cash flows do matter. If the government has promised to make pension and other payments that on a flow basis drain all its revenues, something has to give. As it has in Detroit.

A too-clever thoughtA good response occurred to me, to those cited by Josh who want to argue that underfunding is a mere $1 trillion. OK, let's issue the extra $1 trillion of Federal debt. Put it in with the pension assets. Now, convert the pensions entirely to defined-contribution. Give the employees and pensioners their money now, in IRA or 401(k) form. If indeed the pensions are "funded," then the pensioners are just as well off as if they had the existing pensions. (This might even be a tricky way for states to legally cut the value of their pension promises)

I suspect the other side would not take this deal. Well, tell us how much money you think the pension promises really are worth -- how much money we have to give pensioners today, to invest just as the pension plans would, to make them whole. Hmm, I think we'll end up a lot closer to Josh's numbers.

Details

I used a geometric Brownian process, dp/p = mu dt + sigma dt with mu = 0.06 (6%) and sigma = 0.20 (20%). The T year arithmetic return is then lognormally distributed R_T = exp( mu - 1/2sigma^2)T + sigma root T e) with e~N(0,1). It has mean E(R_T) = exp(mu*T)=exp(0.06*T), median exp[mu-1/2sigma^2)T] = exp(0.04*T) and mode exp[(mu-3/2*sigma^2)T] = exp(0)=1.